Exploring Risk Preference Stability: A Meta-Analysis Highlights Measurement Discrepancies

February 9, 2025 feature

This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

- fact-checked

- peer-reviewed publication

- trusted source

- proofread

by Ingrid Fadelli , Medical Xpress

Past psychology research suggests that some people are more prone than others to take risks in uncertain situations, such as investing money in risky business ventures, consuming addictive substances or leaving a secure job without any sure alternative prospects. Over the past decades, psychologists and behavioral scientists have been trying to understand the extent to which people's willingness to take risks (i.e., risk preference) is stable and coherent, which means that it tends to remain consistent over time and across different contexts.

Many recent studies have set out to investigate the stability of risk preference and the extent to which it can be considered a coherent personality trait. Yet, the findings collected so far were mixed, which has made it difficult to reach definitive conclusions.

Researchers at the University of Basel in Switzerland recently reviewed several past studies exploring the stability of risk preference in the hope of better understanding the nature of this widely investigated trait. Their analyses, published in Nature Human Behaviour, showed that there is significant variability across existing literature, both in terms of the measures of risk preference used, the sample of participants recruited and the types of risks that were assessed.

'Understanding whether risk preference represents a stable, coherent trait is central to efforts aimed at explaining, predicting and preventing risk-related behaviors,' wrote Alexandra Bagaïnii, Yunrui Liu and their colleagues in their paper. 'We help characterize the nature of the construct by adopting a systematic review and individual participant data meta-analytic approach to summarize the temporal stability of 358 risk preference measures.'

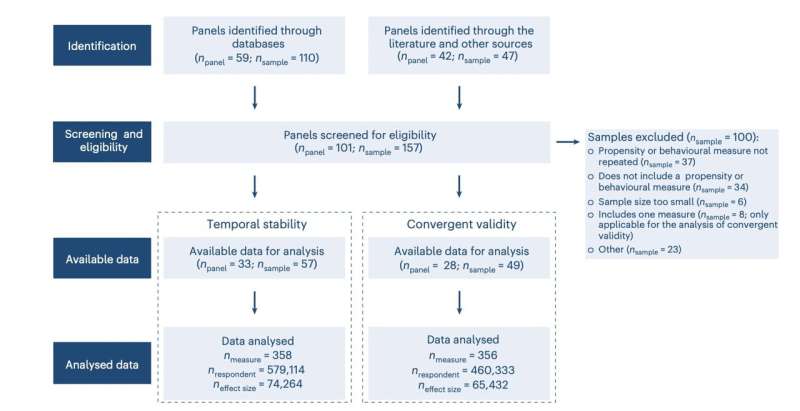

As part of their meta-analysis, the researchers reviewed 33 past longitudinal studies, which involved 57 samples, for a total of 579,114 participants. To compare these studies, they divided the risk preference measures used by the teams involved into three broad categories, as well as the demographic characteristics of participants.

'Our findings reveal noteworthy heterogeneity across and within measure categories (propensity, frequency and behavior), domains (for example, investment, occupational and alcohol consumption) and sample characteristics (for example, age),' wrote Bagaïnii, Liu and their colleagues.

'Specifically, while self-reported propensity and frequency measures of risk preference show a higher degree of stability than behavioral measures, these patterns are moderated by domain and age.'

Bagaïnii, Liu and their colleagues also conducted an analysis assessing the degree to which different measures of risk preferences used in past studies aligned (i.e., their convergent validity). Their findings showed that their convergent validity was low, meaning that the measures employed in past literature did not necessarily capture a single trait but instead different types of tendencies to take risks.

'Our results raise concerns about the coherence and measurement of the risk preference construct,' wrote Bagaïnii, Liu and their colleagues.

Overall, this recent meta-analysis highlights the inconsistencies in how risk preference was measured and conceptualized in previous research. The findings of the team's analyses could guide future studies focusing on people's risk preferences, potentially prompting the development of more precise definitions of risk preference and more reliable measures that could be applied across a wide range of contexts.

More information: Alexandra Bagaïni et al, A systematic review and meta-analyses of the temporal stability and convergent validity of risk preference measures, Nature Human Behaviour (2025). DOI: 10.1038/s41562-024-02085-2.

© 2025 Science X Network